Automotive Plastics Manufacturing Trends in 2024

Ever since its boom in the early 1900s, automotive manufacturing has continued to prosper into the twenty-first century. Cars, vans, public transport, and heavy goods vehicles are becoming ever more accessible, with commercially ready models and their production processes showing profound growth alongside the emergence of Industry 4.0. But how beneficial is plastic to the automotive industry, and what does it show on a global scale?

21st Century Automotive Industry Trends

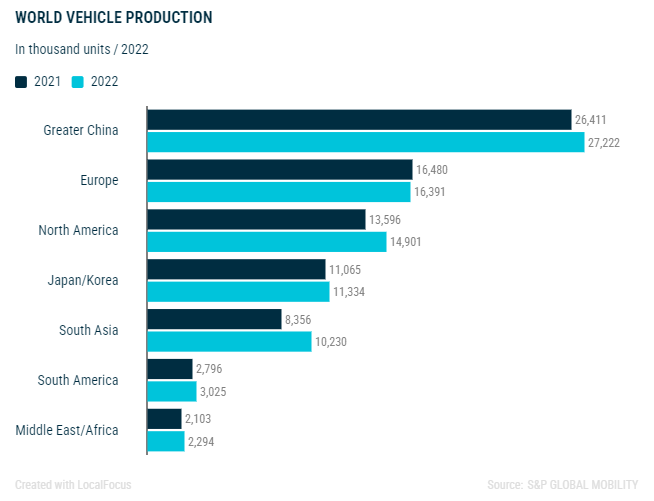

Every year, the number of vehicles that populate our roads has grown exponentially, with no sign of stopping. An estimated 1.5 billion vehicles are in use around the world, a statistic backed up by the increasing growth of automotive manufacture. In 2022, The European Automobile Manufacturers’ Association reported a 5.7% increase in vehicle production to the previous year, totaling 85.4 million new vehicles produced around the world.

With this annual increase, it is no surprise that automotive manufacturing has come under fire in recent years for its contribution to global warming and the fossil fuels crisis, as well as straining a supply chain dependent on critical materials.

Passenger vehicles can contain up to 50 different types of critical materials, of which elements such as cobalt (used in electric automotive batteries) make up a majority of conflict demands from untenable mining processes. Along with commonly sought materials such as rubber, plastic, aluminum, and steel, automotive manufacture is reliant on a number of material factors that begs the question: Is its future unsustainable?

For the past decade, automotive manufacturing trends have been looking to tackle this question with the emergence of Industry 4.0, and the economic benefits of electric vehicles (EV), shared and autonomous mobility, as well as a renewed focus on materials that can contribute to a circular economy.

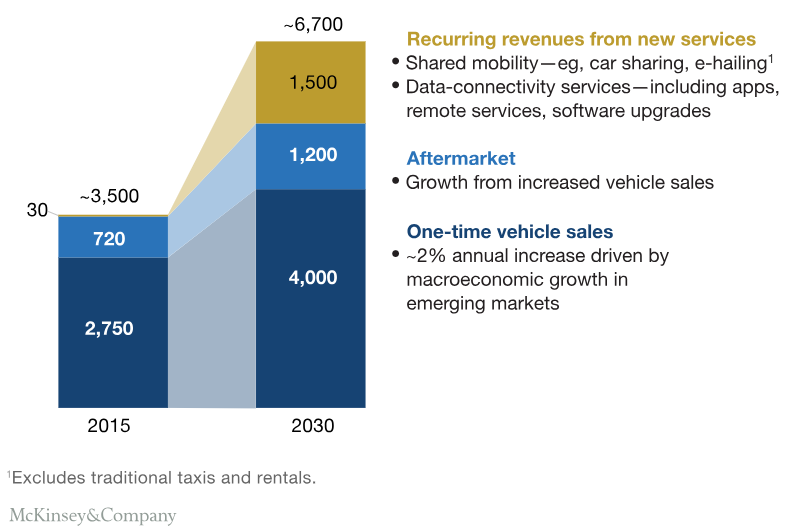

By 2025, plastics and composite materials are expected to make up 8% of a production vehicle’s total share of material, with the majority parts continuing to be produced from steel and aluminum. Additionally, forecasts for 2030 show an uptick in electric and hybrid vehicle technology, as well as an increased interest in shared mobility.

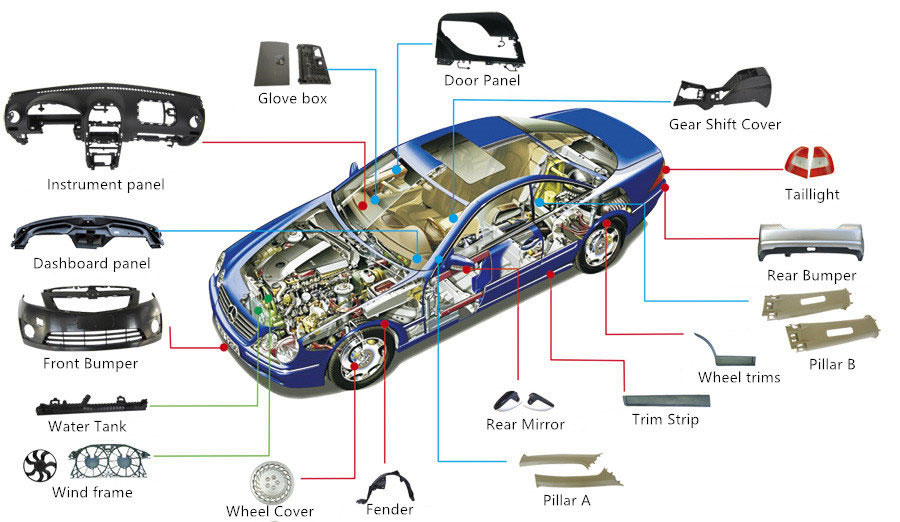

Plastics and composite materials built in automobil. Source: Plastivision

Managed fleets of shared vehicles look to reduce the cost of mobility and will impact key markets such as China and Europe by up to 50%, accounting for 1 out of 10 vehicles sold.

Autonomous mobility continues to fuel interest in the market for shared vehicles, and subsequently, fit-for-purpose mobility solutions such as e-hailing services. North America and Germany have seen over 30% annual growths in car-sharing members in the space of five years, showcasing an opportunity for materials such as composites and plastics to accommodate for tailored vehicle designs: driving unique properties like robustness, lightweight, and passenger comfort.

Automotive Plastics Manufacturing Throughout History

If posed the question, “what are cars made of?”, few people would jump at the thought of plastics. Aside from salient materials like steel and aluminum, plastics have existed prominently within automotive manufacture ever since the car entered serial production.

Coincidentally, the invention of artificial plastic and the birth of the automobile occurred around the same time period. In 1909, the world’s first synthetic plastic, coined Bakelite, was created by Leo Baekeland. Just one year prior, The Ford Motor Company produced its first Ford Model T, regarded by contemporary culture as the world’s first mass-affordable, consumer vehicle.

Although the Model T Ford wouldn’t gain global attraction until its serial production kicked off in the first quarter of the century, its manufacture coinciding with breakthroughs in polymerization would eventually lead to a unique partnership for plastics and automobiles.

23 years after Bakelite, fiber reinforced plastics were invented from a mixture of glass fibers and polymer resin. This new composite material quickly gained attraction from the automotive industry, spawning a range of fiber-reinforced plastics often utilizing thermoset polymers.

Thermosetting plastics helped to produce strong and durable shaped components that were easier to mass produce over traditional methods of folding sheet metal. The first fiberglass car, the Stout Project Y, was a coupe built in 1946, eight years before fiberglass bodies would begin being mass produced for Chevrolet.

The first fiberglass car, the Stout Project Y. Source: Undiscoveredclassics.com

The 1960s revolutionized the field of polymer research with the adoption of polypropylene. Thanks to its light weight and mechanical properties, polypropylene continues to be used in automotive manufacture to this day.

Plastic eventually found its purpose in major vehicle components and body parts. In the 1970s, the revolutionary plastic bumper spawned a whole generation of aesthetic, lightweight vehicles that demonstrated the rigid and durable capabilities of the material, able to absorb four to five times more energy than alternative bumpers. Nowadays plastic parts are ubiquitous with lightweighting innovation on the very latest automotive models.

Plastic parts make up 8% of today’s passenger vehicle material. These plastic and composite parts are specially designed to withstand rigorous weather and operating conditions, including extreme temperatures, dynamic loading, and electrical currents, as well as humidity and corrosion. Below is a list of the most commonly produced plastic parts in the automotive manufacturing industry.

List of Plastic Automotive Parts

| – Vehicle bumpers and exterior components |

| – Engine covers |

| – Cable insulation |

| – Seats |

| – Interior panels |

| – Dashboards, knobs, and switches |

| – Fuel caps |

| – Headlamp/taillight lenses |

| – Wheel covers |

Advantages of Plastics in Automotive Manufacturing

There are many advantages to using plastic in automotive manufacture over alternate materials like metal. Not only are metals heavier, but they surprisingly offer little impact resistance and tensile strength.

Over time, metal begins to rust if not treated with protective coatings—coincidentally, these coatings are also made from specialized polymers. Plastics resolve a number of strength and durability issues, while showcasing aesthetic versatility for more components.

Here are some key reasons for plastics use in automotive manufacture:

| – Lightweighting |

| – Energy Efficiency |

| – Safety and Durability |

| – Costefficiency |

Lightweighting

Plastic and composite parts are much lighter than heavy metal molded parts. This is particularly significant for heavy body panels and underskirts as the effect on the vehicles end-use can show a dramatic increase in energy efficiency 100kg of plastic can replace up to 300kg of traditional materials and has shown to reduce a car’s fuel consumption by 750 liter. This is particularly notable for future EVs and tackling the challenge of extending the distance of a single charge.

Energy Efficiency

The aforementioned benefits of lightweighting a vehicle has been proven to improve fuel efficiency, extending the distance vehicles can travel while reducing their CO2 output. Countries around the world continue to challenge this rate of reduction with fuel economy targets.

Japan recently noted a 96% improvement in fuel efficiency for passenger vehicles over the last two decades. As well as energy reduction in end-use applications, further reductions can be seen in plastics manufacture, with many more opportunities for recycling material using clean energy. This also eliminates a large demand for new parts, as the automotive industry works to embrace a circular economy. However, the challenges to plastics recycling remain prevalent.

Safety and Durability

Contrary to belief, plastic parts can easily outlast strong metals with the correct production processes and post treatment. Thermoset plastics are most commonly utilized in the automotive industry for manufacturing large, solid parts. The plastic showcases impressive strength after curing, unable to be re-shaped, though beneficial for its dielectric properties, corrosive resistance, and low-tooling production costs.

In summary, thermosets offer high-performance in conjunction with advantageous mechanical properties, at a lower production cost. Similarly, composites provide a wider array of possibilities for automotive plastics manufacturing, able to employ materials such as carbon fiber and glass fiber reinforced polymers that offer identical advantages, at the cost of production value.

Cost-Efficiency

With increased sustainability operations throughout the plastics industry, the cost of manufacturing plastic automotive parts has been heavily reduced, thanks to advanced technological production insights from Industry 4.0 and Internet of Things, along with the amount of recycled material continuously increasing. Assembly costs and tooling are also dramatically reduced with plastic molding.

The process offers a continuous source of reliable, serial manufacturing, with the ability to reduce lead times by combining multiple parts into a single mold and allowing for complex shapes.

Processes in Automotive Plastic Manufacturing

While many production processes apply to plastics manufacturing, automotive parts required for their high impact and safety features are routinely manufactured in mass using different methods of molding. These processes allow for consistent, reliable serial production that is fast and cost-effective.

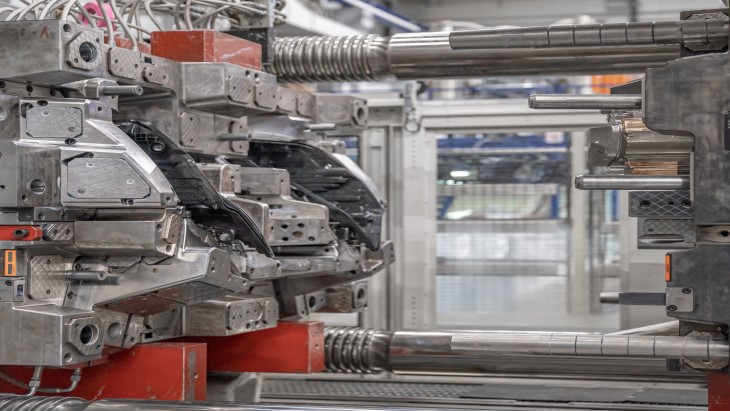

Injection Molding

Injection molding is the process of injecting molten plastic into a hydraulic press mold. Plastic pellets are melted down and injected through a screw into the chamber, wherein the material’s molecular structure is altered by extreme temperature. This strengthens the newly formed plastic part as it cures and solidifies. The hardened part is then removed from the mold mechanically or by air compression.

In the case of automotive parts, thermosets are favored for their increased strength and corrosion resistance. Thermoset plastic parts require a similar process coined Reaction Injection Molding (RIM), whereby two liquid components are used in the molding process and injected at low pressure.

On contact, they perform a chemical reaction that increases temperature and pressure inside the mold, eventually producing a thermoset part. This process can be greatly adapted to apply a range of formulations and pre-mixed material, altering thermoset properties for different physical performance requirements.

Automotive Plastic Injection Molding. Source: Holly Plastics Parts.

Compression Molding

Compression molding is a popular process with plastic and advanced composites. It involves preheated polymer placed inside an open, heated mold cavity. A cover, or plug, is then pressed against the plastic, filling the space inside the mold. Compression molding is beneficial for parts requiring even thickness, parts of varying sizes, and parts which may be too complex for injection molding.

Parts suited to compression molding are often pre-formed to help improve the overall performance of the compression process. Its advantage to automotive plastic manufacture lies with its potential to create parts with intricate geometries, offering molded composite parts with longer fibers.

Automotive Plastics Manufacturing Trends: 2024 and Onwards

With the increasing demand for next-generation automotive manufacturing solutions, coupled with challenges to sustainable practices regarding the climate crisis, the plastics industry is set to grow alongside the automotive industry for the foreseeable future.

The global market size of automotive plastic parts was valued at 35 billion USD in 2019, with a forecast rise of up to 83 billion USD by 2027 based on a CAGR of 11.1%. These statistics align with the current automotive plastics market size, calculated to be worth 70 billion USD as of 2023, with an expected ten-year growth that will see the market almost double; forecasted market size for 2033 sits at 136 billion USD.

Automotive Plastics Market Outlook from 2023 – 2033. Source: Future Market Insights (FMI)

The key 2023 automotive industry trends fueling market growth in plastics manufacturing primarily involve increasing energy efficiency for petrol and electric vehicles by reducing weight and opting for more sustainable solutions down the automotive supply chain.

By 2025, automakers are aiming to phase-out petrol and diesel internal combustion engines, with VW looking to fill this gap with 70 new EV vehicle models by 2028. The biggest challenge facing EV manufacture is production expense and concerns for thermal runaway. EV lithium-ion batteries require extensive research into their potential for thermal generation. Consequently, R&D into fire retardant options for battery housings and components had led to an increased interest in the benefits of advanced plastics and composites.

These materials diminish propagation of flames with effective fire retardant or heat transfer resistant properties. The research continues to aid in EV weight reduction, with materials such as carbon fiber reinforced plastic being tested for lightweight structural batteries, lowering EV mass to battery capacity.

More investments are being made into research and development for plastics manufacturing, including Internet of Things to connect operations to a central network, and the adoption of A.I. and machine learning to monitor and report on part conditions in-mold.

How Automation Improves Production Efficiency

While the automotive plastics industry is expected to grow exponentially in the next ten years, the challenges surrounding achieving automotive energy efficiency begin with plastics production and its necessary processes.

A current solution that is already changing the way plastics manufacturing operates for the automotive industry is through process optimization for industry 4.0. The plastics industry has already begun to integrate cutting-edge IoT automation into its production processes. Advanced sensors play a crucial role in detecting early faults, providing detailed data that was once hard to obtain.

Coupled with sophisticated software solutions, this technology streamlines the entire manufacturing operation. The implementation of artificial intelligence can further ensure the highest quality control, with cloud software allowing data monitoring to take place remotely. This ultimately saves both time and money for automotive plastics manufacturers.

The sensXPERT solution can provide high quality, real-time data in a single solution.

sensXPERT’s latest process control solution, Digital Mold, is paving the way for industry 4.0 in automotive plastics manufacturing. It seamlessly integrates with molding solutions, accommodating both plastics and composite materials.

The Equipment-as-a-Service solution provides real-time process control by comprehending internal and external mold conditions. Material characterization sensors within manufacturing molds use dielectric analysis to measure material behavior in real time, while the Edge Device gathers this data and presents it through a user-friendly interface, namely the WebApp.

It allows automotive plastics manufacturers to monitor, adjust, and predict optimal molding conditions. The sensXPERT Digital Cloud Service is a further visual aid to historical process data from multiple machines, regardless of location, ensuring transparency and compliance with regulations while supporting smart financial decisions.

sensXPERT’s quality assurance testing can be conducted during molding, swiftly identifying errors and minimizing waste. It promotes sustainable practices by reducing production costs, shortening cycle times, lowering energy consumption, and eliminating unnecessary scrap.

In essence, sensXPERT is a comprehensive solution driving efficiency, sustainability, and regulatory adherence across the automotive plastics manufacturing sector.

Conclusion

Automotive manufacturing is undergoing significant transformations in response to the growing number of vehicles on the road and increasing concerns about sustainability and resource consumption. With approximately 1.5 billion vehicles worldwide, the industry is facing growing demands to manufacture more energy efficient vehicles to tackle strains throughout the supply chain, as well as critical material demands.

However, the future of automotive manufacturing is being shaped by Industry 4.0, the rise of electric vehicles (EVs), shared mobility, and an unwavering focus on automotive plastics adoption. Thermosets and composites are projected to constitute 8% of a production vehicle’s material composition by 2025, while EVs and shared mobility are expected to revolutionize the market, reducing costs and accounting for a significant portion of future vehicle sales.

Plastics have played a crucial role in automotive manufacturing history, offering advantages such as lightweighting, energy efficiency, recyclability, safety, durability, and cost-efficiency. Modern manufacturing processes like injection molding and compression molding have further streamlined mass manufacturing.

Looking ahead, the automotive plastics industry is set to grow substantially, reaching an estimated market size of 136 billion USD by 2033. The key trends include enhancing energy efficiency, sustainability, and adopting IoT automation, sensors, and artificial intelligence for process optimization.

sensXPERT will be documenting the challenges that automotive manufacturers face in an upcoming article, ‘Overcoming Automotive Plastics Production Challenges’. Stay tuned for the latest on this evolving sector.